The DWP committee enquiry is publishing its report into intergenerational fairness. Among other issues, the committee calls for the scrapping of the state pension Triple Lock.

The committee proposes replacing the Triple Lock in 2020 with an earnings link combined with an inflation-proofing underpin. Tom McPhail, Head of retirement policy: “Politicians are chronically compromised when making any policy decisions which might be detrimental to older citizens. You only have to look at the turnout in general elections to understand why: 78 percent of the over 65s voted, compared to just 43 percent of the eligible under 25s.

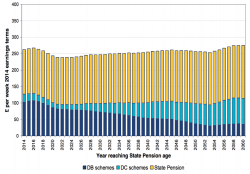

The Triple Lock has served an important function in bringing pensioner incomes back into line with the rest of the population. It is also important to recognise that pensioner incomes will change again in the future, we are about to hit ‘peak DB’ after which successive pensioners will be increasingly reliant on the state pension and on defined contribution arrangements (see chart below). Any measure to curb either of these in the next few years could rapidly push more pensioners back into poverty.”

Hargreaves Lansdown has recently made proposals to the Treasury for reform of pension taxation to encourage increased saving and investing. These include the abolition of the pension Lifetime Allowance and a redesign of pension tax relief, replacing it with an age related top-up weighted in favour of younger workers. We have also proposed to the Cridland review of state pension age the possibility of using underwritten annuities as a mechanism to deliver more generous state pensions at younger ages to those with compromised life expectancy.

Tom McPhail: “Younger workers need more help saving for the long term, they also have the potential to benefit from decades of compound investment growth. We’d like to see the government abolish some of the disincentives to save which bedevil the older generations, such as the Lifetime Allowance and the Annual Allowance Taper, whilst also directing its pension incentives more effectively by weighting them towards younger workers.”

Housing

The committee report explores the distorting effect that housing has on relative generations’ wealth, whilst also acknowledging that housing policy sits beyond its remit. Tom McPhail: “We need more houses, a lot more houses. It is ludicrous that so many 20 and 30 somethings are finding it so hard to buy a house, even the Chief Economist as the Bank of England has talked about the attraction of investing in a house rather than a pension. A house should be to live in and a pension should be an investment. We won’t eliminate the distorting effect that housing has on savings policy until the government finds ways to get a lot more houses built.