Seventy-two percent of UK employees would struggle to cope if their income fell by £570 a month, the average amount lost by 80 percent of families after a cancer diagnosis. Comment from Paul Avis, Marketing Director – Canada Life Group Insurance.

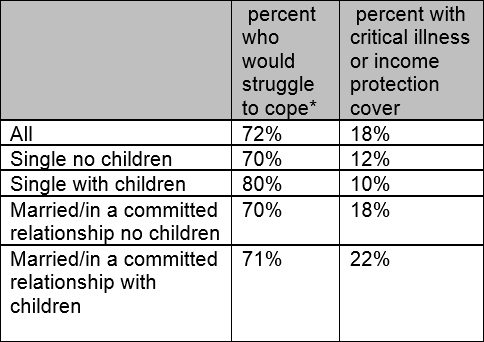

This rises to 80 percent of single parent workers. But only 18 percent have some form of critical illness or income protection cover. Average worker has less than £3,300 in savings and could live off this for just three months based on current expenditure. Two in five couldn’t meeting housing payments if income was lost due to cancer. Nearly three in four (72 percent) respondents say they would struggle to cope if their income fell by the average amount lost by 80 percent of families after a cancer diagnosis (£570 a month1), new research from Canada Life Group Insurance reveals. This rises to 80 percent of single parent workers, including 63 percent who say it would be very difficult to cope in these circumstances.

Cancer now affects one in two people during their lifetime; incidence rates among those aged 25-49 have risen by 20 percent in the past 20 years.2 Yet UK employees are putting their finances on the line by failing to protect their incomes. Only 18 percent of employees have some form of critical illness or income protection cover to help them financially if they were to develop a serious illness such as cancer, and 46 percent are not worried by their lack of protection – suggesting they have given little thought to how a long-term illness could affect their income. Despite being the most vulnerable group, only 10 percent of single parents have cover.

Table 1: Single parents most vulnerable to financial struggles of cancer but do not protect their income

*If faced with average loss of income for 80 percent of families due to cancer (£570 a month)

*If faced with average loss of income for 80 percent of families due to cancer (£570 a month)

Average worker has less than £3,300 in savings to fall back on if they became ill

UK employees have an average of £3,292 in savings, lasting less than six months if used to fund the average £570 shortfall in monthly income. With the typical UK worker spending £1,000 per month, their savings would last just three months if they were diagnosed with cancer and completely unable to work. Worryingly, nearly one in five (18%) employees have no savings at all, and an additional 10 percent have less than £1,000 to fall back on. Two in five couldn’t meeting housing payments if income was lost due to cancer. If faced with a £570 reduction in monthly income, UK employees admit they would struggle to afford essential expenditure such as utility bills (72%), the weekly food shop (57%) and mortgage or rent payments (43%). TV, internet and phone costs (51%) would also be difficult to meet, along with car and other travel costs (50%).

Nearly half (45%) would need to apply for State benefits to get by if they were diagnosed with cancer and lost their income. However, benefits are becoming increasingly difficult to qualify for, and the amount of financial assistance given to those unable to work due to illness (but capable of some work related activity) has been cut from £5,312 to £3,801 per year.3 With average expenditure of £1,000 a month, most workers would struggle to get by on this amount of financial support. One in five (22%) would worry about being a financial burden on their family and 16 percent say they would be more worried about their finances than their health. Paul Avis, Marketing Director at Canada Life Group Insurance, comments: “A head in the sand approach to the financial impact of cancer is putting families’ futures at risk. Cancer accounts for nearly seven in ten critical illness claims4 and incidence rates have risen across all age groups, affecting those of working age as well as older people. As cancer survival rates also rise,5 more will undergo extended periods of treatment, likely resulting in a leave of absence from work and a reduction of income. It’s clear from our research that most families would struggle to cope with this financially, but few have protection in place to provide the support they would need.

“With the ability to meet essential areas of expenditure such as housing, utility and food costs at risk, employers should consider the workplace benefits they can offer to prevent valued members of staff having to experience such hardship. Group income protection and critical illness policies provide vital financial support through difficult periods of illness and are relatively inexpensive to provide, and only 7 percent of respondents had cover such as this in place. They also come with a host of support services such as counselling and rehabilitation, helping enable a return to work if possible: a positive result for both employer and employee.”