Online estate agents HouseSimple.com has compiled a list of jobs where the average salary would mean – without some help from the bank of mum and dad – you’ll be saving into the next century before you are in a financial position to buy an average first-time buyer property in the UK*.

According to HouseSimple research, full-time bar staff on an average annual salary of £13,345 would have to save for a staggering 112 years to get onto the housing ladder. And hairdressers on the average income for the profession, would be able to afford to buy an average first-time buyer property by 2120. The most recent ONS Annual Salaries data** was used to compile the list of jobs, ranked by the length of time it would take someone in that job to have enough money for a deposit on a £198,309** property, the price of an average first-time buyer property in the UK according to the Land Registry.

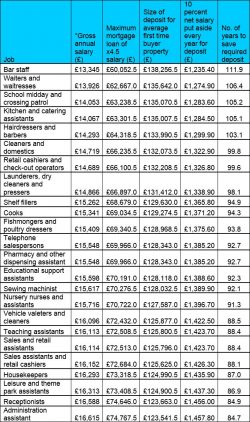

HouseSimple calculations were based on savers putting aside 10 percent of their net salary every year for a house deposit, and that the maximum mortgage loan they could secure would be four-and-a-half times their gross annual salary. The list of jobs that are part of the 22nd Century Club, because people working in these jobs won’t be able to afford to buy a property until at least 2100, include services that we rely on or use regularly; including hairdressers, cooks and cleaners. For example, a cook on an average wage, would need to toil away in the kitchens for more than 94 years to have a large enough deposit to buy an average first-time buyer property. While, on an average nursery nurse’s salary, it would take an individual just over 91 years, saving 10 percent of their salary a year, to afford to buy. The following table shows the list of jobs where the average salary would mean you’re still saving for a deposit on an average first-time buy property into the next century.

Alex Gosling, CEO of online estate agents HouseSimple.com comments: “Although house prices have dropped recently, affordability still remains a major problem in the UK. Clearly, no-one is going to be saving into the next century to buy a property, but these illustrative figures do provide a stark picture of the struggle many first-time buyers face trying to buy. Of course, there are plenty of areas of the country where house prices are within reach of people earning lower incomes and the local prices are much lower than the UK average. However, large swathes of the South of England and London are so far out of reach of low-income earners, that home ownership would be impossible without a big withdrawal from the bank of mum and dad.”