The only thing that seems to be certain about Brexit is; on-going uncertainty. What does this mean practically for business and particularly procurement professionals, in managing continental suppliers in this uncertain and changing world? And what impact might it have if you reply on cheap labour from within the EU? Article by Nigel Ransom, 528 Advisory.

Let’s start by looking at the legislation which affect the relationship a business has with its continental suppliers: The Single Market – enables suppliers to send their goods from any EU country to another freely, i.e. no tariff or import duties – this is the area of EU law that covers the four key freedoms: goods, services, capital and people. The Customs Union – sets the standard paperwork and agreements for the transportation of goods across the EU (and beyond), it also mandates that all countries set standard tariffs for goods coming in from non-EU countries – i.e. the rest of the world. The Customs Union excludes food and agriculture.

Looking at the Single Market and Customs Union alone and putting aside challenges such as standards and other regulation, there are three basic scenarios that should be considered when mapping the impact Brexit may have on your company: We remain in the EU and there is no change – this seems unlikely at the moment, but politicians such as Vince Cable have been talking it about in recent weeks.

We get no deal and revert to World Trade Organisation rules – this again seems an unlikely outcome at the moment, and although it would mean paying tariffs and charges on some goods which currently arrive free of import duty from within the EU, it also gives the UK access to non-EU markets, i.e. the rest of the world, for those same goods and services – currently priced out of consideration by the EU’s import duties.

Removal of access to low cost labour from Europe – We need also to consider the free movement of labour in our analysis. The potential major reduction in the availability of low cost labour from Europe may cause price increases for some goods, either directly or in the supply chain. This is likely to be noticed most where suppliers have a significant reliance on the use of such labour, either long term or when the need is temporary e.g. fruit picking, harvesting and other peak demands times such as Black Friday and Christmas.

So, what are the practical steps companies should do now in order to be ready for any of the foreseeable changes to come?

Supplier Segmentation

From your supplier list, starting with direct, but also including the critical indirect, identify and segment your suppliers:

Suppliers should be identified by: Being an EU company supplying goods or services from an EU country; Being a company, which is reliant on significant raw materials or components from the EU. This ideally should be segmented by percent of price of the goods supplied; Being a company, which is reliant on the availability of low cost labour from EU. This ideally should be segmented by percent of price of the goods supplied; Identification of items sourced from outside of the EU but which transit via land through the EU, which should also include goods transiting through Rotterdam.

Given the complexity in modern supply chains, the list of suppliers each company produces is likely to be quite long. Each organisation’s knowledge of its suppliers will be fully tested and more likely involve liaising with suppliers to establish the latest cost assumptions and supply chain challenges.

Sequencing the list:

The list needs to be sequenced by each company in order of importance. This is likely to identify the supplier with the biggest impact on costs escalation for the goods and services you sell onto your customers, either as finished goods or larger sub-assemblies and components.

Analysis of the list:

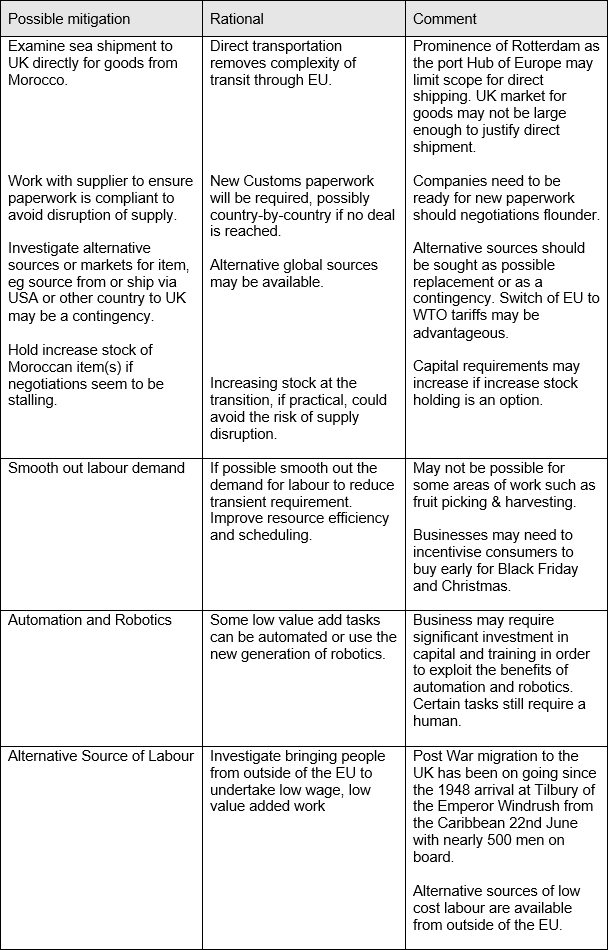

Each supplier on the list needs to be looked at in turn, although segmentation by country and product may be useful. Dependent upon the challenges faced there are a number of strategies and remedies, which can be applied to reduce the impact of Brexit cost increases and, ideally, identify some of the cost saving opportunities.

Let’s look at the example of a UK company mainly sourcing from within the UK, except for some items sourced in Morocco and currently shipped by sea and land to UK. The company also has a significant transient requirement for low cost EU labour:

Risk

Exit from Customs Union curtails free flow of goods across the EU.

Brexit curtails access to low cost EU labour.

This example highlights the issue of low cost EU labour and identifies some options to move away from that business model. However, some sectors will have an inherent requirement for transient low-cost labour during peak demand.

It is therefore easy to see why an individual approach, supplier by supplier is required. The size, scale and level of internationalisation of each supplier, product and commodity will change the likely remedy selected. Other factors will include level of competition in the market and the geographic spread of the industry.

Pricing the changes:

For each supplier, each of the mitigation options, which are deemed possible, should be priced, as an increase or decrease to the unit cost. The benchmark to measure each contingency against is to: stay with the same supplier, transacting in the same way but applying WTO tariffs rather than Single Market trading.

Completing the first pass of this work will enable companies to identify the biggest cost increase, risk and opportunities available to them and focus scarce resources on managing them appropriately.

Once completed this analysis will give managers: An understanding of the impact of Brexit on your suppliers and inbound supply chain with expected costs, both increases and decreases.

An understanding of the options available to buyers and suppliers to offset some, or all, of the costs and impact of Brexit under the worst-case scenario.

Ability for buyers and suppliers to start contingency planning and mitigation actions for Brexit.

A clear view of which suppliers are already mitigating the risks and costs of Brexit Identification of new suppliers from outside of the EU, which were previously not competitive due to EU tariffs.

Ability to work with new suppliers to take advantage of improved pricing once Brexit is completed.

A document that can focus and support involvement with trade bodies to resolve and minimise the negative impact of Brexit on your business and sector.

A working document that you can evolve and be updated as the negotiations proceed. By taking action now, it is more likely you can mitigate the effects of Brexit, and perhaps even find ways to benefit from the changes ahead of us.