£10,000 saved in basic high street account today will be worth just £9,849 in real terms after one year at this rate of inflation. Even in the top fixed-rate one-year bonds, £10,000 will be worth just £9,905 in 12 months. £10,000 held in cash would be worth just £9,740 in real terms a year on.

Today’s CPI figure, although an improvement on last month, is still bad news for savers as the lethal combination of rising inflation and low interest rates continue to bite, buy-to-let investment platform PropertyPartner warned today.

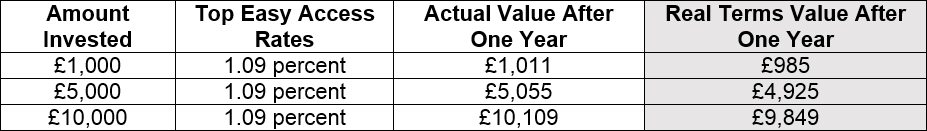

With CPI rising above expectations again this month to 2.6 percent, a deposit of £1,000 in some of the high street’s highest-yielding easy access accounts will be worth just £985 in real terms a year on.

The high street’s top six easy access savings accounts currently offer average interest of 1.09 percent AER. At that rate, savings of £5,000 will be worth just £4,925 in real terms in 12 months’ time while £10,000 will be worth only £9,849 in today’s money. The threat of value erosion is likely to force many to consider other areas to invest their money.

Buy-to-let investors in some areas are investing in homes yielding in excess of five percent. On Property Partner, the average yield available is currently 3.2 percent with yields of up to 4.99 percent, plus any potential gains if property prices rise. Investors will now need to assess the level of risk that they’re comfortable with in order to protect the value of their capital.

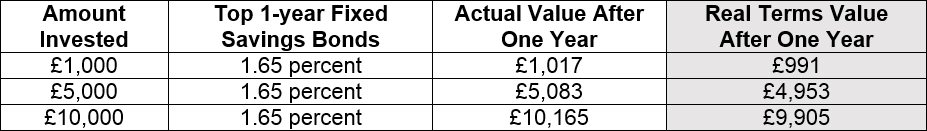

Even savers using the top fixed one-year bonds will be sitting on a shrinking nest egg. Sums of £1,000, £5,000 and £10,000 would become £991, £4,953 and £9,905 respectively in real terms in a year. The top five one-year fixed bonds pay an average 1.65 percent AER.

Table: Value of £1k, £5k, £10k high street easy access savings in actual and real terms after one year

*Based on average rate from Bank of Cyprus UK, Tesco Bank, Post Office Money, RCI Bank UK, Leeds Building Society, and Virgin Money. (collated 18/07/17 from MoneySupermarket), using CPI inflation of 2.6 percent.

Table: Value of £1k, £5k, £10k fixed 1-year savings bonds in actual and real terms after one year.

*Based on average rate from Al Rayan Bank, Masthaven, Vanquis Bank, Zenith Bank, Clydesdale Bank and Yorkshire Bank. (collated 18/07/17 from MoneySupermarket), using CPI inflation of 2.6 percent